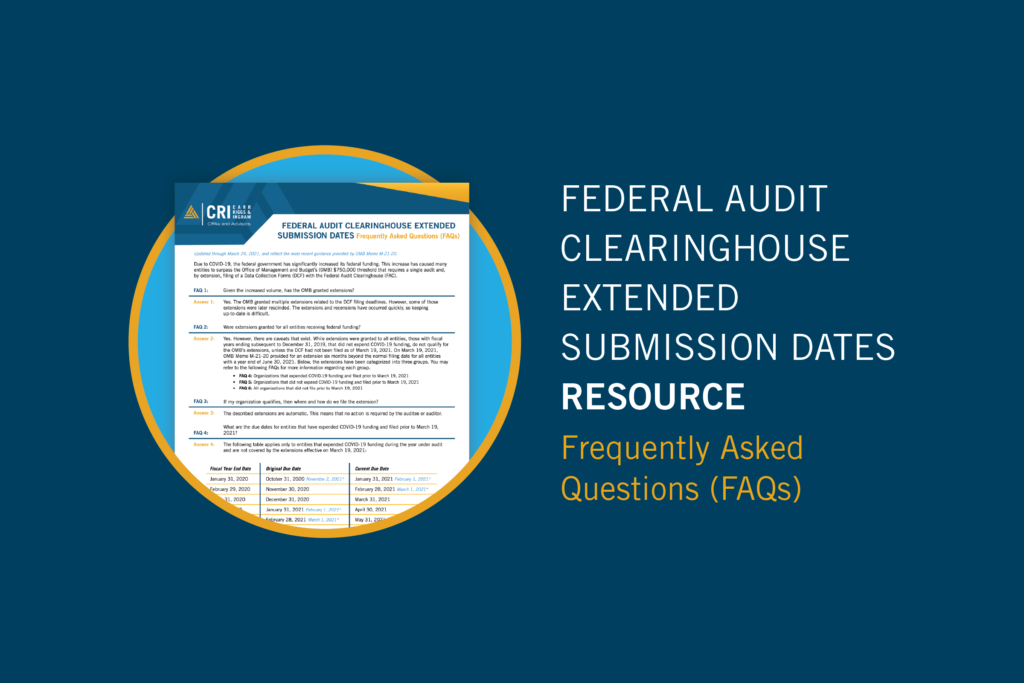

Federal Audit Clearinghouse Extended Submission Dates FAQs

- Contributor

- Gwen Mansfield-Vogt

Mar 9, 2021

Due to COVID-19, the federal government has significantly increased its federal funding. This increase has caused many entities to surpass the Office of Management and Budget’s (OMB) $750,000 threshold that requires a single audit and, by extension, filing of a Data Collection Forms (DCF) with the Federal Audit Clearinghouse (FAC). Download our helpful resource to get answers to more frequently asked questions.